Riding a motorcycle in Michigan offers a sense of freedom like no other. But with that freedom comes the responsibility to protect yourself and your bike. A motorcycle accident can happen, and when it does, the consequences can be severe.

That’s what makes motorcycle insurance so important. It’s your financial safety net, safeguarding you from the potentially devastating costs of an accident. However, with so many options available, it can be confusing to know what you really need.

Let our seasoned Muskegon motorcycle attorney break down the essentials of motorcycle insurance in Michigan, helping you make informed decisions that protect you on the road.

Understanding the Basics of Motorcycle Insurance

In Michigan, motorcycle insurance is mandatory. Unlike other vehicles on the road, motorcycles aren’t covered under the no-fault insurance system, meaning you won’t receive the same benefits as car drivers in the event of an accident. That’s why it’s essential to understand the specific requirements and protections available to you as a rider.

A motorcycle is defined as a vehicle with a saddle or seat for the rider, designed to travel on not more than three wheels in contact with the ground. However, a motorcycle is not classified as a motor vehicle under Michigan’s no-fault law, which means motorcyclists aren’t automatically entitled to no-fault benefits.

But what happens if you’re injured in an accident involving a car or truck? If the motor vehicle is insured, you, as a motorcyclist, are entitled to receive Personal Injury Protection (PIP) benefits from the insurer of the motor vehicle. These benefits can cover medical expenses, lost wages, and other related costs.

Another important requirement in Michigan is helmet use. While helmets are generally required, there’s an exception. If you’re over 21 and carry at least $20,000 in medical benefits coverage specifically for motorcycle accidents, you can legally ride without a helmet. However, many choose to wear one regardless, as it provides an extra layer of protection on the road.

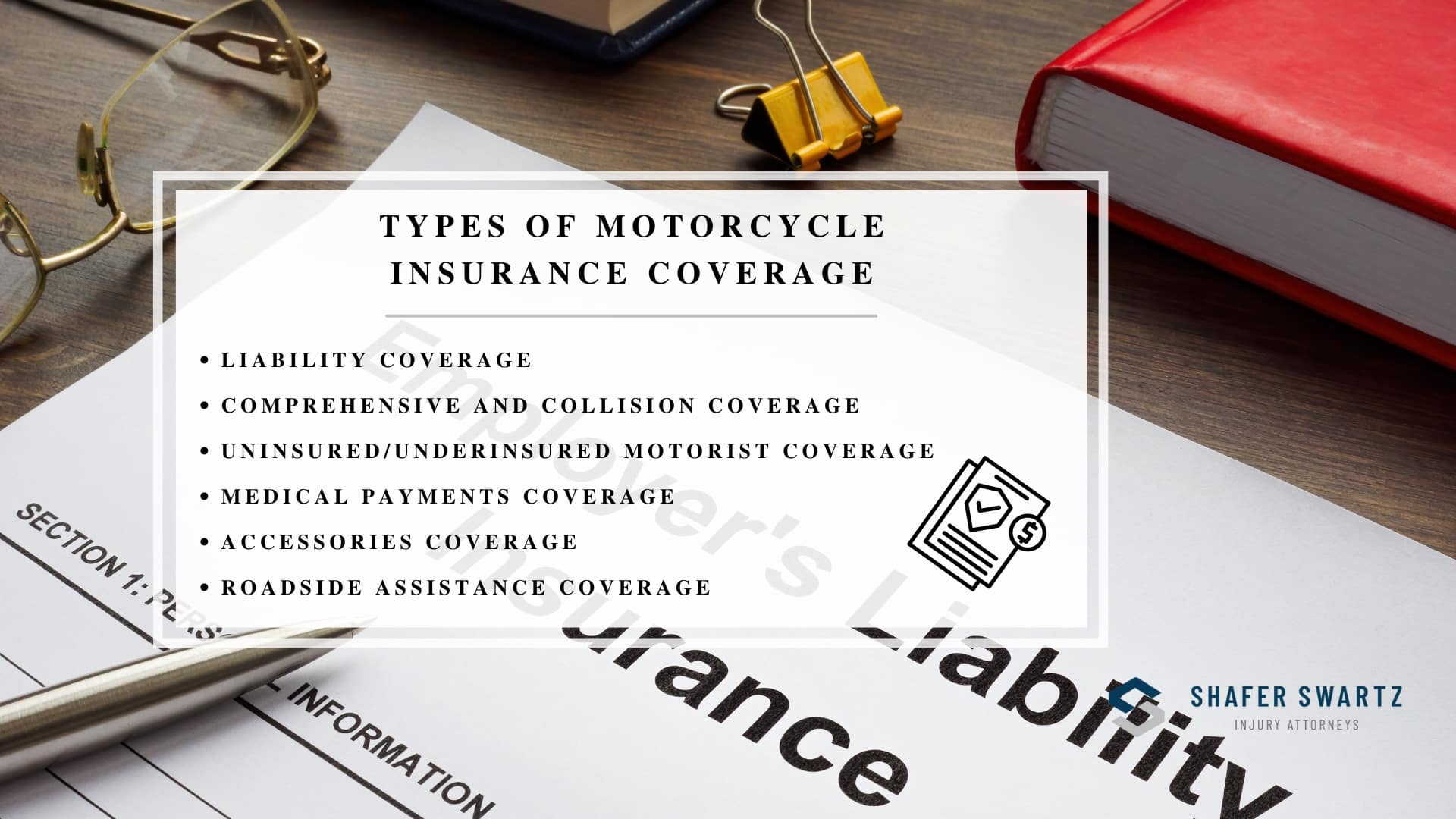

Types of Motorcycle Insurance Coverage

There are different types of motorcycle insurance coverage available in Michigan.

Liability Coverage

Liability coverage is the most basic and mandatory type of motorcycle insurance in Michigan. It’s designed to cover the costs if you injure someone else or damage their property in an accident where you’re at fault. The state requires you to carry liability coverage of at least:

-

- $20,000 – for injuries or death to one person

- $40,000 – for injuries or death to two or more people in a single accident

- $10,000 – for property damage

These are the minimum requirements, but you might want to consider higher limits for better protection. After all, if an accident leads to costly medical bills or significant property damage, the minimum coverage might not be enough to cover all expenses.

Comprehensive and Collision Coverage

Collision coverage pays for repairs or replacement if your motorcycle is damaged in an accident, regardless of who’s at fault. Comprehensive coverage covers non-collision incidents, such as theft, vandalism, or damage from severe weather. Though optional, these coverages are important, especially if your motorcycle is valuable or if you rely on it as your primary mode of transportation.

Uninsured/Underinsured Motorist Coverage

In Michigan, where not everyone on the road carries adequate insurance, having uninsured/underinsured motorist coverage can be a lifesaver. Uninsured Motorist (UM) coverage protects you if you’re in an accident with a driver who doesn’t have insurance, while Underinsured Motorist (UIM) coverage steps in when the at-fault driver’s insurance isn’t enough to cover your medical expenses or damages.

Optional Coverages

Beyond the basics, there are several other optional coverages you might want to consider adding to your policy, depending on your needs and circumstances.

-

- Medical Payments Coverage – helps pay for your medical expenses, regardless of who’s at fault in an accident

- Accessories Coverage – covers damage or loss to any accessories or custom parts you’ve added to your motorcycle

- Roadside Assistance Coverage – provides assistance if your motorcycle breaks down or you experience a flat tire

Assessing Your Needs: Factors to Consider

Choosing the right motorcycle insurance coverage isn’t a one-size-fits-all situation. It’s about understanding your specific needs and circumstances. Here are some key factors to consider:

Your Riding Habits and Frequency

How often do you ride your motorcycle? If you’re on your bike daily or take long trips, you might want to consider more comprehensive coverage options. The more time you spend on the road, the higher your risk of being involved in an accident. Conversely, if you only ride occasionally or use your bike for short, local trips, choose a policy that reflects your less frequent usage.

The Value and Age of Your Motorcycle

How much is your motorcycle worth? How old is your motorcycle? If you own a newer, high-value bike, comprehensive collision coverage can protect your investment from various risks, such as theft or damage. For older bikes with a lower value, the cost of these coverages might not be worth it and outweighs the potential payout in the event of a claim, so opt for just the basic liability coverage.

Financial Situation and Risk Tolerance

Higher coverage limits and optional coverages can provide more security but come with higher premiums. Assess your ability to handle potential out-of-pocket expenses if an accident occurs. If you can comfortably cover higher costs yourself, you might choose lower coverage limits to save on premiums. However, if you prefer to minimize financial risk, investing in more comprehensive coverage might be a better fit.

The Role of a Motorcycle Attorney in Insurance Claims

Motorcycle insurance claims can sometimes encounter issues, including disputes over fault, disagreements on coverage limits, or challenges in proving the extent of damages. Insurance companies might also try to minimize their payout or deny claims based on technicalities or misunderstandings of the policy.

Such disputes can be frustrating and confusing, especially if you’re trying to recover from an accident. A local attorney can be a valuable ally in these situations. Our legal professionals can help you navigate the insurance claims process, ensuring you receive the compensation you’re entitled to.

If you find yourself facing difficulties with your motorcycle insurance claim, Shafer Swartz PLC is here to assist you. Our experienced Muskegon motorcycle attorneys can help you gather necessary evidence, interpret policy details, and advocate for fair compensation based on your circumstances. To schedule a consultation, contact us today at or here.